Drone Insurance: A Dive into Coverage Types and Benefits

In recent years, drones have become increasingly prevalent across various industries, from aerial photography to surveying and delivery services. As drone technology advances, so does the need for responsible drone ownership. One crucial aspect of reliable drone operation is insurance. This blog post will delve into drone insurance, covering what it is, why you need it, and how to quickly obtain it using AutoPylot.

What is Drone Insurance?

Drone insurance is a type of insurance coverage designed to protect drone owners/operators from financial losses resulting from accidents, damage, theft, or liability claims related to the operation of their drones. Just like car insurance, drone insurance policies can vary in coverage and cost depending on factors such as the value of the drone, its intended use (personal or commercial), and the level of coverage desired.

Types of Drone Insurance

Liability Insurance:

Liability insurance is a fundamental component of drone insurance, covering third-party bodily injury or property damage claims that may arise during drone operations. Whether it’s an unintentional collision with a person or damage to someone’s property, liability insurance helps cover the legal and medical expenses associated with such incidents.

Hull Insurance (Physical Damage Coverage):

Hull insurance focuses on the drone itself, offering coverage for damages resulting from accidents, crashes, or technical malfunctions. Particularly valuable for commercial operators, hull insurance mitigates the financial impact of repairs or replacement, allowing operators to recover swiftly from unforeseen damages.

Insurance for Other Equipment (e.g., Payload Insurance):

This type of insurance extends coverage beyond the drone to protect valuable attachments like cameras and sensors. Payload insurance safeguards against potential damage or loss, ensuring that high-value equipment remains financially protected. Especially important for operators using specialized payloads, this coverage enhances the overall risk management strategy for drone operations.

Why You Need Drone Insurance

Risk Mitigation

Like any technology, drones are susceptible to various unforeseen events, such as technical malfunctions, weather challenges, or human error. Drone insurance is a crucial risk mitigation tool, providing operators with a safety net for unexpected accidents or incidents. With insurance, operators can confidently navigate their flights, knowing that potential accidents are covered.

Financial Protection

Accidents happen, and the financial implications can be significant when they involve drones. The financial burden can be overwhelming, whether it’s damage to third-party property, bodily injury claims, or repairs to the drone itself. Drone insurance offers financial protection, ensuring the operator is not left shouldering the total cost of legal fees, medical expenses, or drone repairs. This protection is especially critical for commercial operators, as it safeguards the financial health of their business against unforeseen incidents.

Unlock More Drone Jobs

Insurance is often a prerequisite for securing contracts and jobs for those operating drones professionally. Clients and businesses hiring drone services typically require proof of insurance as part of their risk management protocols. By having comprehensive insurance coverage, operators meet these client requirements and position themselves as responsible and reliable professionals in the industry. This, in turn, enhances their credibility and increases their chances of securing more drone jobs.

What Drone Insurance Can Cover

- Third-party bodily injury

- Third-party property damage

- Physical damage to the drone

- Physical damage to other equipment

- Theft of the drone

- Loss of payload or equipment

- Medical expenses

- Additional pilots

How to Obtain Drone Insurance with AutoPylot

One of the benefits of flight planning with AutoPylot is that, in addition to being an FAA-approved provider of B4UFLY and LAANC services, operators can purchase drone insurance without ever leaving the app.

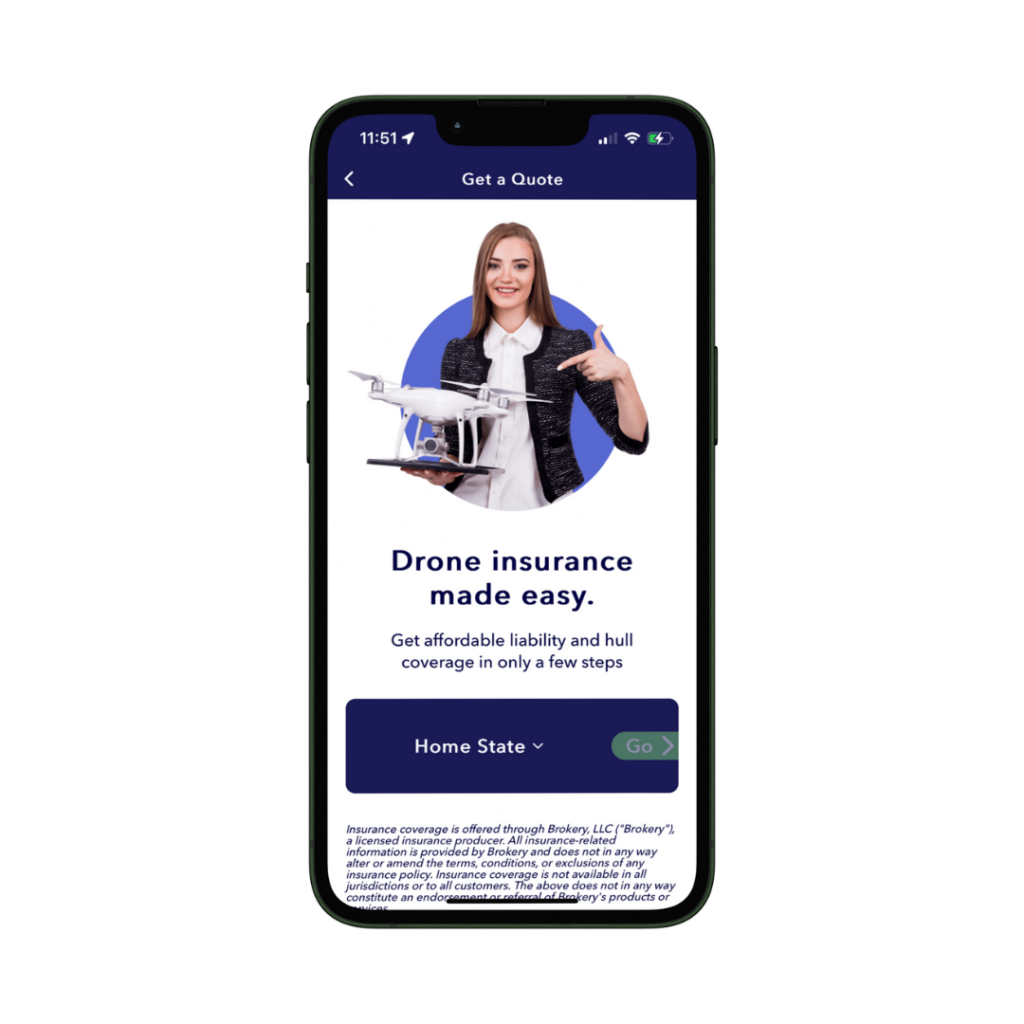

- Download AutoPylot: Start by downloading the AutoPylot app on iOS or Android.

- Get Insurance: From the menu, navigate to insurance.

- Input your state: Select your home state to see if coverage is avalible. Remember, AutoPylot is adding new states weekly!

- Receive a quote: Complete the application by inputting the liability limit you need, adding hull insurance, and telling us about yourself.

- Purchase coverage: Select between a month-to-month policy or enjoy some savings with an annual policy.

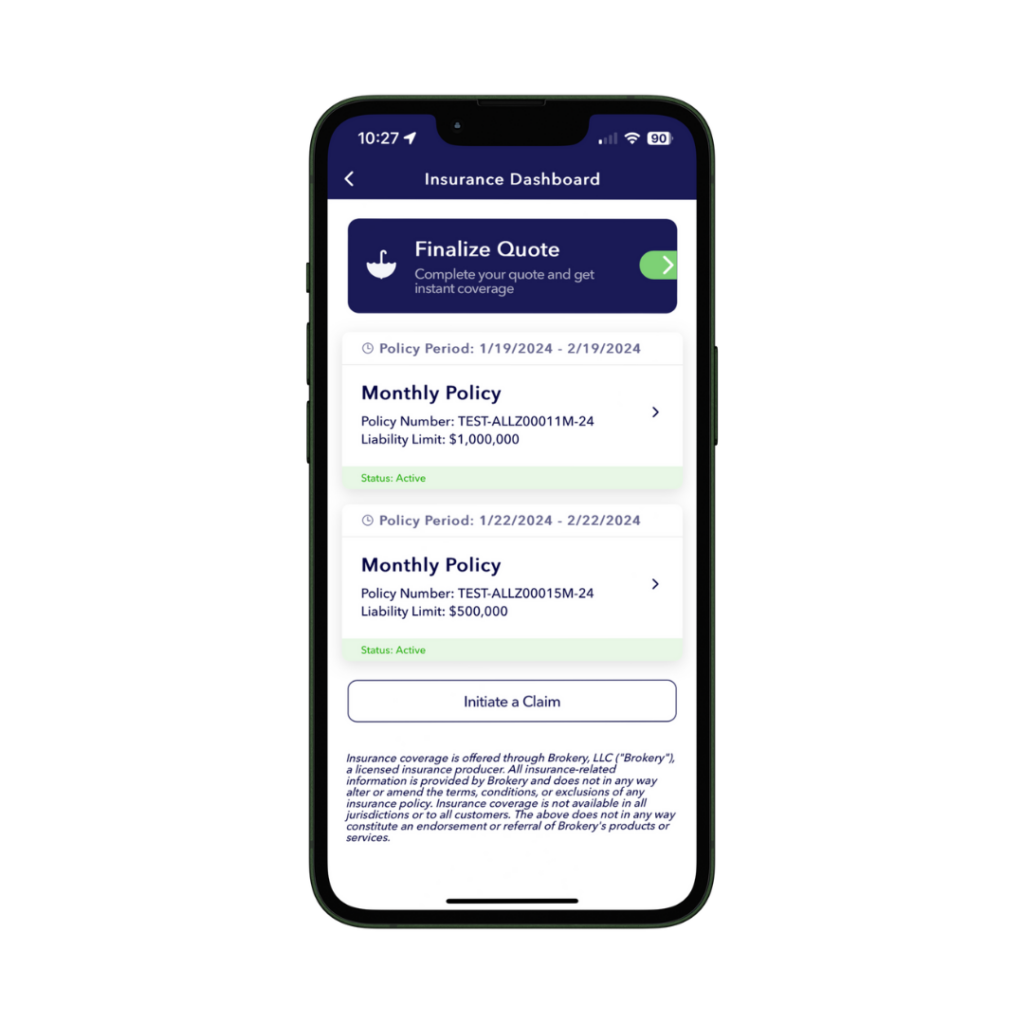

- Access Policy: You can now easily access your policy and its documents from the insurance dashboard.

As the popularity of drones continues to soar, responsible drone ownership includes securing the right insurance coverage. Whether you’re a hobbyist or a commercial operator, understanding the types of coverage available and why you need it is essential. With the convenience of platforms like AutoPylot, obtaining drone insurance has always been challenging, providing drone enthusiasts and professionals with the protection they need to navigate the skies safely and responsibly.